Thumbnail representing top robo-advisors and AI investing tools of 2025

Introduction: Investing Is Getting Smarter in 2025

AI and automation are transforming how we invest. Robo-advisors and AI-driven platforms now build, manage, and rebalance portfolios automatically — making professional-level investing accessible to everyone.

What Are Robo-Advisors?

A robo-advisor is an automated investment platform that uses algorithms and AI to build and manage your portfolio based on your goals, risk tolerance, and timeline.

✅ Key Benefits:

📈 Automated portfolio management

🤖 AI-driven rebalancing

💰 Lower fees than traditional advisors

🧠 Data-driven investment decisions

Robo-advisors automate portfolio building and management

Top 5 Robo-Advisors and AI Investing Tools in 2025

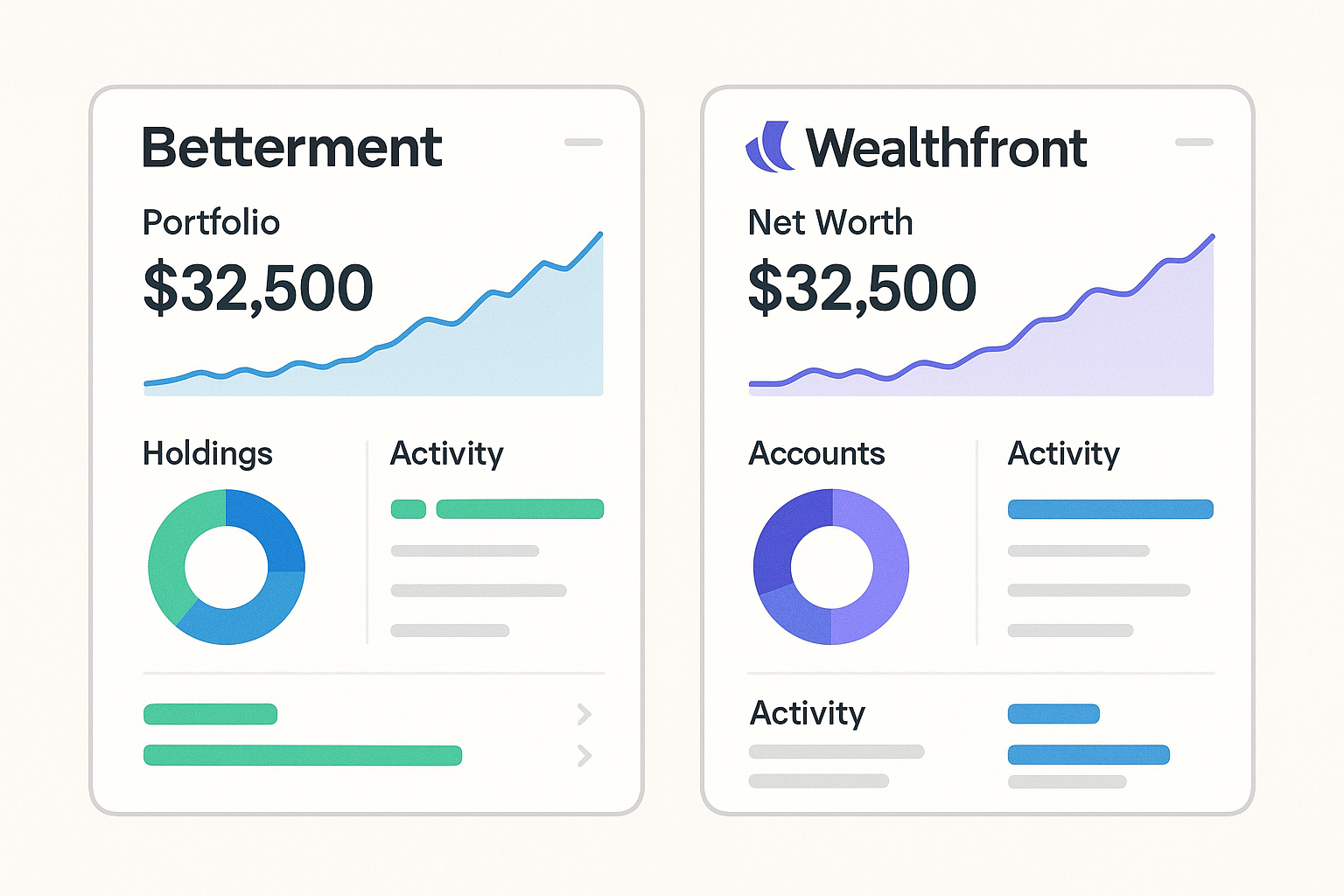

1️⃣ Betterment – Best for Beginners

Minimum investment: $0

Fees: 0.25% annually

Features: Automated rebalancing, tax-loss harvesting, goal tracking.

2️⃣ Wealthfront – Best for Tax Optimization

Minimum investment: $500

Fees: 0.25% annually

Features: AI-driven tax-loss harvesting and financial planning tools.

Betterment and Wealthfront are top robo-advisors for beginners and tax efficiency

3️⃣ Schwab Intelligent Portfolios – Best for No Fees

Minimum investment: $5,000

Fees: $0

Features: AI asset allocation and automatic rebalancing.

4️⃣ M1 Finance – Best for Custom Portfolios

Minimum investment: $100

Fees: $0

Features: Custom portfolio creation + AI optimization.

5️⃣ SoFi Automated Investing – Best for Integrated Finance

Minimum investment: $0

Fees: $0

Features: Combines robo-advisory with banking and loans.

Comparison of the best AI investing platforms in 2025

Pros and Cons of Robo-Advisors

✅ Pros:

Fully automated investment management.

Low fees and minimums.

Easy diversification and rebalancing.

❌ Cons:

Limited customization (except platforms like M1).

Less human advice compared to traditional advisors.

How AI Improves Investment Decisions

📊 Big Data Analysis: AI scans thousands of assets in real time.

🤖 Machine Learning Models: Continuously improve allocation strategies.

📈 Behavioral Insights: AI adjusts risk based on user behavior and market changes.

Conclusion + CTA

AI-powered robo-advisors make investing smarter, simpler, and more efficient. Whether you’re a beginner or an experienced investor, automation can help you grow wealth consistently with less effort.

👉 Action Step: Try one robo-advisor this week. Set your risk level, fund your account, and watch AI manage your portfolio — hands-free.

AI-driven investing will dominate portfolio management in the future

📌 SEO Section

🔑 Core Keywords

Best robo-advisors 2025

AI investing platforms

Automated investing tools

📊 SEO Keyword Analysis Table

Keyword Search Volume CPC ($) Competition SEO Potential (⭐)

Best robo-advisors 2025 14,300 20.10 Medium ⭐⭐⭐⭐⭐

AI investing platforms 10,900 19.20 Medium ⭐⭐⭐⭐

Automated investing tools 8,400 18.50 Medium ⭐⭐⭐⭐

📌 Meta Description (150 chars)

Explore the best robo-advisors and AI investing tools in 2025. Compare top platforms, fees, and features to automate your wealth-building strategy.

---

🔖 Related Tags

#RoboAdvisors #AIInvesting #Fintech2025 #WealthBuilding #AutomatedInvesting