Thumbnail showing AI-assisted retirement planning for 2025

Introduction: The New Era of Retirement Planning

In 2025, retirement planning is no longer just about saving — it’s about strategic, AI-driven investing. Artificial intelligence now helps investors forecast income needs, optimize portfolios, and ensure long-term financial stability.

---

Why Traditional Retirement Planning Falls Short

❌ Static Models: Old strategies ignore real-time market changes.

❌ Emotion-Based Decisions: Human bias leads to poor timing.

❌ Limited Diversification: Traditional plans often miss global opportunities.

AI solves these challenges by analyzing millions of data points to build smarter, adaptive retirement portfolios.

AI-driven portfolios adapt to market changes for better retirement security

---

How AI Transforms Retirement Planning

1️⃣ Personalized Risk Profiling

AI evaluates your spending, savings, and goals to tailor asset allocation.

2️⃣ Predictive Income Forecasting

AI models estimate how long your savings can last and suggest adjustments.

3️⃣ Dynamic Portfolio Rebalancing

Automatic adjustments keep your plan on track through volatility.

4️⃣ Global Asset Integration

AI includes ETFs, bonds, REITs, and dividend stocks from multiple regions.

AI dashboards track performance and adjust strategy automatically

---

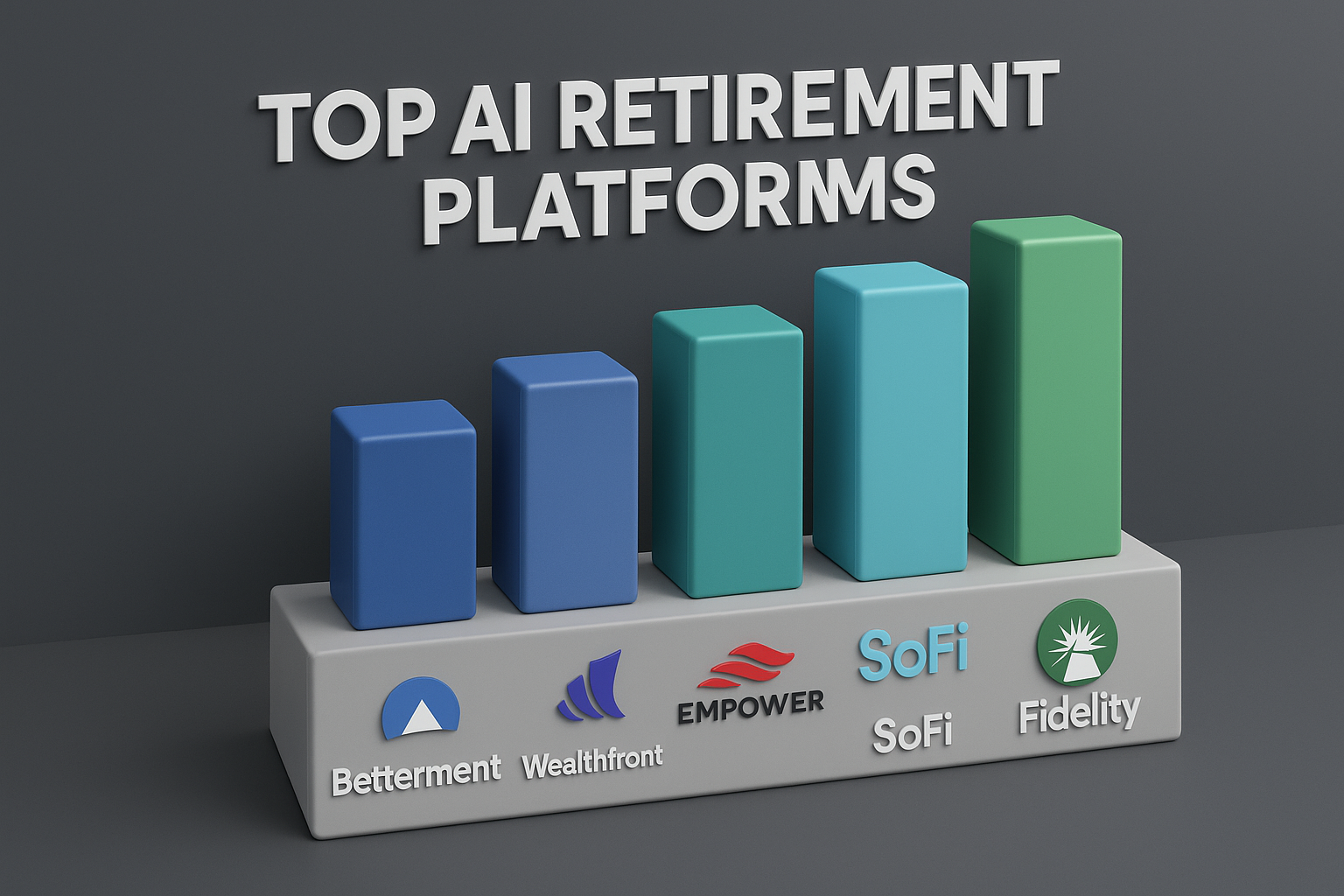

Best AI Tools for Retirement Planning in 2025

Platform Key Feature Best For

Betterment RetireSmart AI retirement forecasting Beginners

Wealthfront Path Income planning + tax optimization Mid-level investors

Empower Personal Dashboard Portfolio + expense tracking High-net-worth users

SoFi Retire Integrated with loans and banking All-in-one solution

Fidelity AI Planning Predictive risk adjustment Long-term planners

Compare AI tools for smarter retirement planning in 2025

---

Steps to Build Your AI-Powered Retirement Plan

1️⃣ Define Your Goal: Target retirement age, monthly expenses, and lifestyle.

2️⃣ Connect Your Accounts: AI tracks and predicts performance.

3️⃣ Let AI Optimize: Rebalancing, risk control, and diversification handled automatically.

4️⃣ Review Quarterly: Adjust as needed with new income or spending data.

---

Conclusion + CTA

AI is revolutionizing retirement planning by making it personalized, predictive, and adaptive. With smart algorithms handling complex calculations, you can retire confidently knowing your money is working intelligently for you.

👉 Action Step: Choose one AI retirement platform this week. Enter your age, savings, and goals — and let AI design your retirement strategy.

AI-driven strategies ensure smarter, stress-free retirement planning

---

📌 SEO Section

🔑 Core Keywords

Retirement planning with AI

AI investment strategies 2025

Best AI retirement tools

📊 SEO Keyword Analysis Table

Keyword Search Volume CPC ($) Competition SEO Potential (⭐)

Retirement planning with AI 12,800 18.90 Medium ⭐⭐⭐⭐⭐

AI investment strategies 2025 10,400 17.60 Medium ⭐⭐⭐⭐

Best AI retirement tools 8,900 16.70 Medium ⭐⭐⭐⭐

📌 Meta Description (150 chars)

Discover how AI transforms retirement planning in 2025. Compare the best tools, strategies, and platforms to secure your financial future.

---

🔖 Related Tags

#RetirementPlanning #AIInvesting #Fintech2025 #WealthManagement #SmartFinance