Thumbnail highlighting the best dividend stocks of 2025

Introduction: Dividend Stocks Are the Key to Passive Income

In 2025, dividend stocks continue to attract investors seeking steady income, compounding growth, and reduced volatility. Whether you’re building a retirement portfolio or diversifying your income streams, dividend-paying stocks remain a powerful tool for wealth creation.

What to Look for in a Dividend Stock

💵 Dividend Yield: Percentage of payout relative to stock price.

📈 Payout Ratio: Ideal range is 40–60%. Too high may signal risk.

🔁 Dividend Growth History: Look for consistent annual increases.

🏢 Business Stability: Companies with strong cash flow and low debt.

Key metrics to evaluate dividend-paying stocks

Top 5 Dividend Stocks in 2025

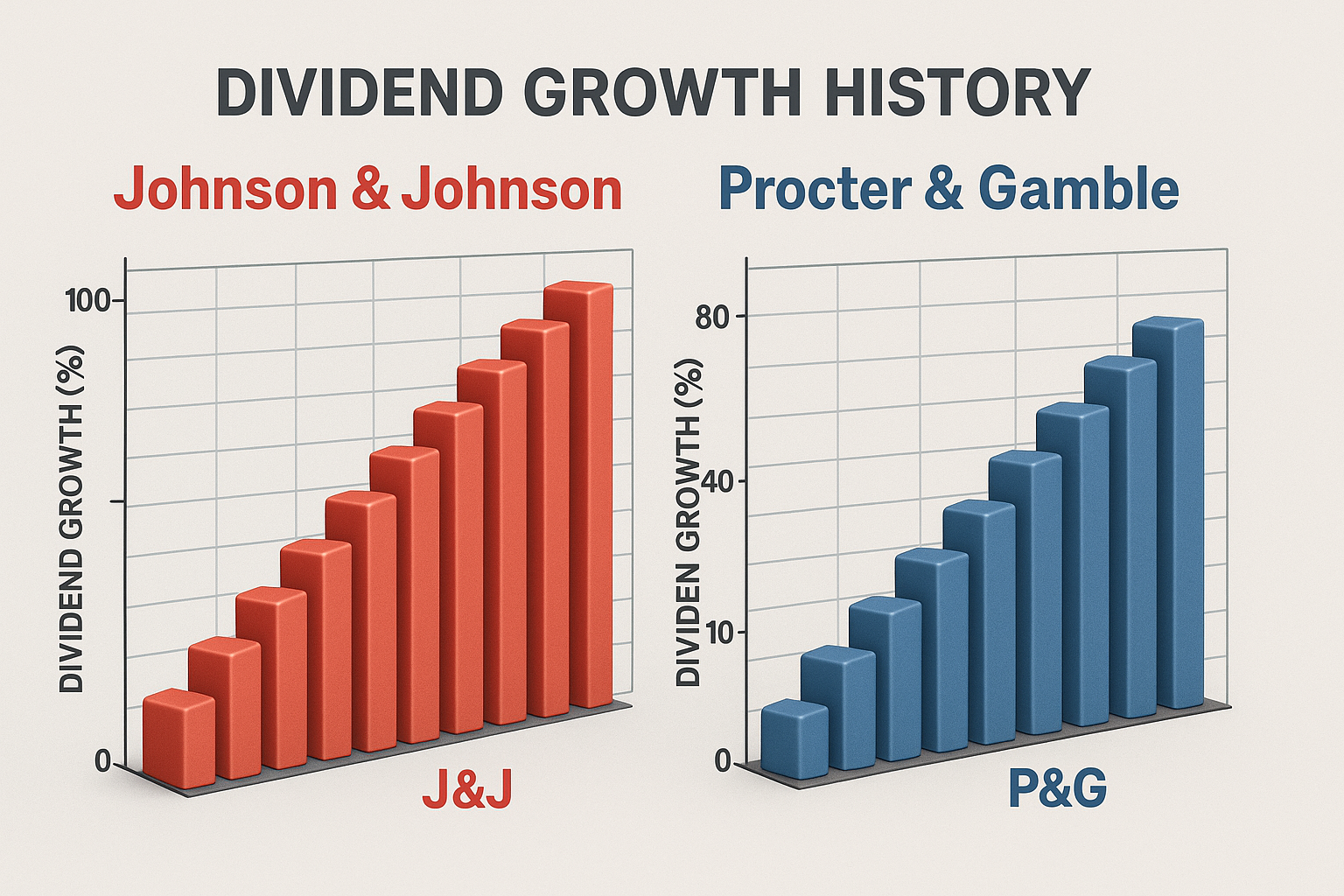

1️⃣ Johnson & Johnson (JNJ)

Dividend Yield: ~2.9%

Dividend Growth: 61 consecutive years.

Why: Consistent healthcare cash flow and recession resilience.

2️⃣ Procter & Gamble (PG)

Dividend Yield: ~2.5%

Dividend Growth: 67 consecutive years.

Why: Strong brand portfolio and stable revenue.

JNJ and PG are reliable dividend aristocrats

3️⃣ Coca-Cola (KO)

Dividend Yield: ~3.1%

Dividend Growth: 61 consecutive years.

Why: Global dominance and predictable earnings.

4️⃣ PepsiCo (PEP)

Dividend Yield: ~2.8%

Dividend Growth: 51 consecutive years.

Why: Diversified revenue streams and strong cash flow.

5️⃣ Realty Income (O)

Dividend Yield: ~5.2%

Monthly dividends and strong REIT performance.

Why: Perfect for consistent passive income.

Comparison of dividend yields and growth across top stocks

How to Build a Dividend Portfolio in 2025

📊 Diversify Across Sectors: Healthcare, consumer staples, real estate.

💸 Reinvest Dividends: Use DRIP (Dividend Reinvestment Plans) to compound returns.

📆 Focus on Growth + Yield: Blend stable aristocrats with higher-yield REITs.

Conclusion + CTA

Dividend stocks in 2025 are not just about income — they’re about financial freedom. By focusing on strong fundamentals, consistent payouts, and growth potential, you can build a portfolio that pays you for decades.

👉 Action Step: Choose at least two dividend aristocrats and reinvest dividends for compounding growth.

Reinvested dividends compound wealth over the long term

📌 SEO Section

🔑 Core Keywords

Best dividend stocks 2025

Dividend investing strategies

Top dividend aristocrats

📊 SEO Keyword Analysis Table

Keyword Search Volume CPC ($) Competition SEO Potential (⭐)

Best dividend stocks 2025 13,200 19.80 Medium ⭐⭐⭐⭐⭐

Dividend investing strategies 10,300 17.40 Medium ⭐⭐⭐⭐

Dividend aristocrats 2025 7,800 16.90 Medium ⭐⭐⭐⭐

📌 Meta Description (150 chars)

Discover the best dividend stocks in 2025. Compare yields, growth history, and build a passive income portfolio with top dividend aristocrats.

🔖 Related Tags

#DividendStocks #PassiveIncome #Investing2025 #DividendAristocrats #WealthBuilding