Thumbnail highlighting the top ETFs for 2025

Introduction: Why ETFs Are Perfect for Long-Term Investors

ETFs (Exchange-Traded Funds) offer diversification, low fees, and long-term growth — without the need to pick individual stocks. In 2025, ETFs remain one of the most reliable and profitable ways to build wealth steadily over time.

What to Look for in a Growth ETF

💸 Expense Ratio: Lower fees mean higher returns.

📈 Holdings: Broad, diversified assets perform better long term.

📊 Historical Performance: Consistency over 5+ years.

🔄 Liquidity: High trading volume ensures smooth transactions.

Know the key metrics when choosing growth ETFs

Top 5 ETFs for Long-Term Growth in 2025

1️⃣ Vanguard Total Stock Market ETF (VTI)

Why Choose: Covers the entire U.S. stock market.

5-Year Return: ~12%

Expense Ratio: 0.03%

2️⃣ iShares MSCI ACWI ETF (ACWI)

Why Choose: Global diversification across 23 countries.

5-Year Return: ~10%

Expense Ratio: 0.32%

VTI focuses on the U.S., while ACWI offers global exposure

3️⃣ Invesco QQQ Trust (QQQ)

Why Choose: Exposure to top tech giants like Apple and Microsoft.

5-Year Return: ~14%

Expense Ratio: 0.20%

4️⃣ Schwab U.S. Dividend Equity ETF (SCHD)

Why Choose: Dividend growth + stability.

5-Year Return: ~11%

Expense Ratio: 0.06%

5️⃣ ARK Innovation ETF (ARKK)

Why Choose: High-risk, high-reward innovation exposure.

5-Year Return: Volatile but strong upside.

Expense Ratio: 0.75%

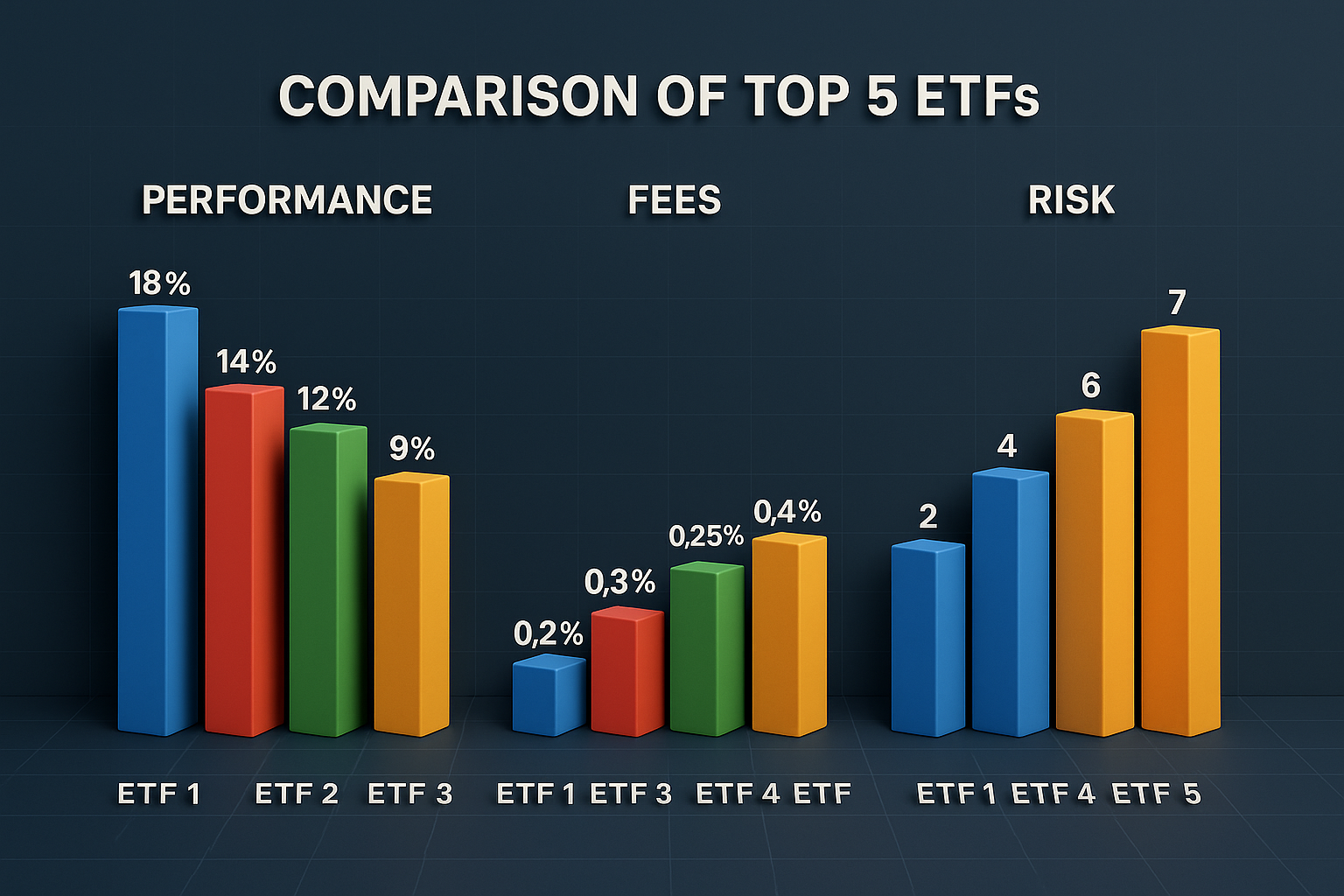

Compare returns, fees, and risk profiles for top ETFs

Building a Growth Portfolio with ETFs

🧠 Core-Satellite Strategy:

Core: VTI or ACWI for broad diversification.

Satellite: QQQ or ARKK for growth potential.

📆 Annual Rebalancing: Adjust to stay aligned with your goals.

💰 Dollar-Cost Averaging: Invest regularly to reduce timing risk.

Conclusion + CTA

ETFs remain one of the smartest ways to grow wealth steadily. By combining broad-market ETFs with focused growth funds, you can balance risk and return for the long term.

👉 Action Step: Choose one core ETF and one growth ETF this week. Start investing small and watch your wealth compound over time.

Long-term ETF investing builds wealth steadily

📌 SEO Section

🔑 Core Keywords

Top ETFs 2025

Best ETFs for long-term growth

ETF investing strategies

📊 SEO Keyword Analysis Table

Keyword Search Volume CPC ($) Competition SEO Potential (⭐)

Top ETFs 2025 15,400 16.90 Medium ⭐⭐⭐⭐⭐

Best ETFs for long-term growth 11,800 15.10 Medium ⭐⭐⭐⭐

ETF investing strategies 2025 9,200 14.40 Medium ⭐⭐⭐⭐

📌 Meta Description (150 chars)

Explore the top ETFs for long-term growth in 2025. Compare returns, expense ratios, and build a strong portfolio with these five powerful ETFs.

🔖 Related Tags

#ETFs #Investing2025 #WealthBuilding #LongTermGrowth #FinanceTips