Thumbnail comparing ETFs and Mutual Funds in 2025

Introduction: Why This Debate Matters in 2025

Both ETFs and Mutual Funds are popular investment vehicles, but which one is better in 2025? With changing market conditions, fee structures, and investor goals, choosing the right option is critical for long-term success.

---

What Is an ETF (Exchange-Traded Fund)?

Definition: A collection of securities traded like a stock on exchanges.

Pros: Low fees, intraday trading, tax efficiency.

Cons: Requires brokerage account, can be volatile.

ETFs offer flexibility and lower fees with stock-like trading

---

What Is a Mutual Fund?

Definition: Professionally managed fund pooling money from many investors.

Pros: Professional management, automatic diversification.

Cons: Higher fees, trades once per day, potential tax inefficiency.

Mutual Funds are actively managed but come with higher costs

---

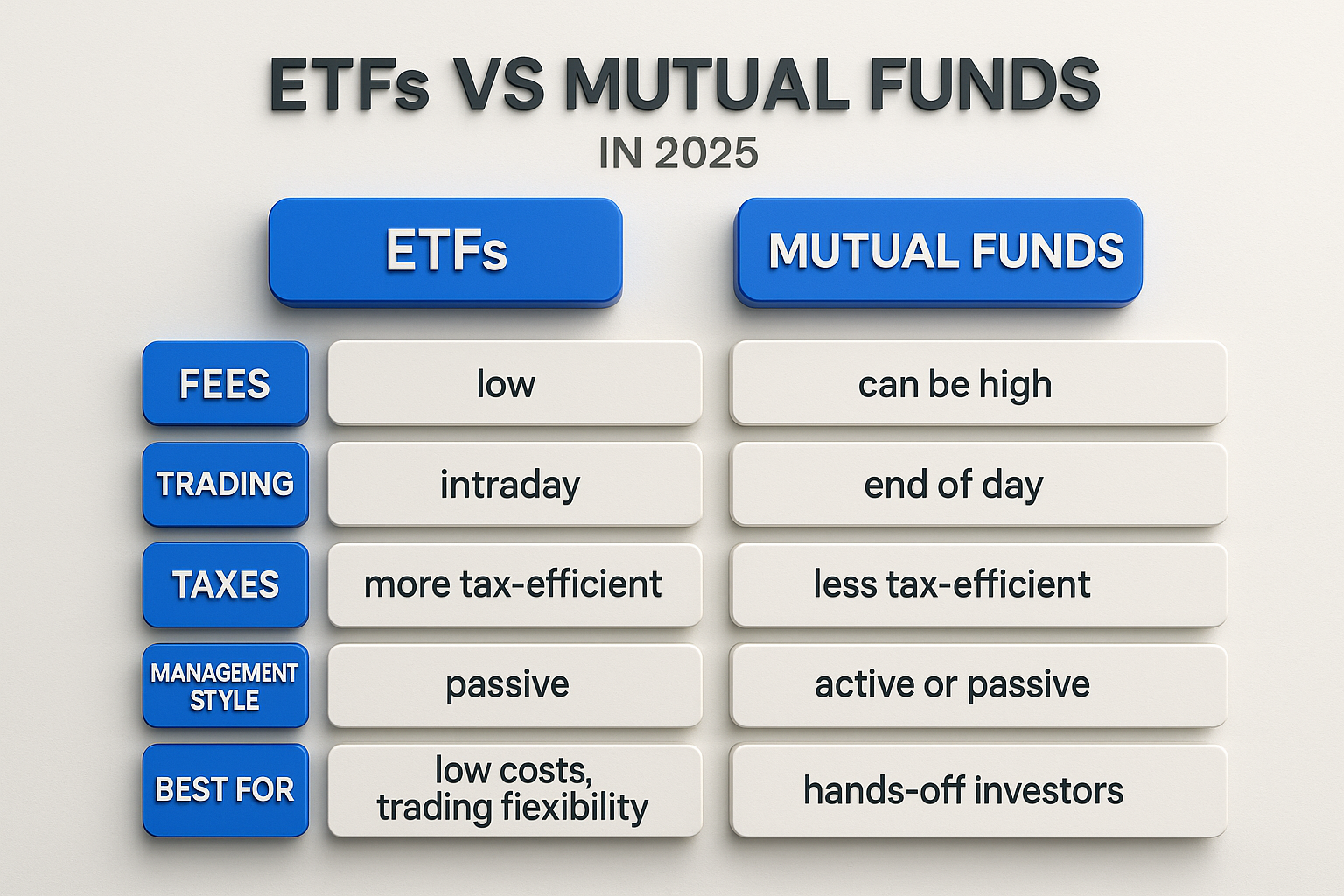

ETF vs Mutual Funds: 2025 Comparison

Side-by-side comparison of ETFs and Mutual Funds in 2025

Feature ETFs Mutual Funds

Fees Low (0.05%–0.25%) Higher (0.5%–1.5%)

Trading Intraday (like stocks) End of day NAV price

Tax Efficiency Generally better Less efficient

Management Style Passive (index tracking) Active (fund manager)

Best For Cost-conscious investors Hands-off beginners

---

Which Option Fits You?

Choose ETFs if: You want low fees, real-time trading, and tax efficiency.

Choose Mutual Funds if: You prefer professional management and don’t want to actively trade.

Pro Strategy: Many investors combine both—ETFs for core holdings, Mutual Funds for specialized sectors.

---

Conclusion: ETF vs Mutual Funds in 2025 + CTA

There’s no single “best” choice—only what aligns with your goals. ETFs are cost-effective and flexible, while Mutual Funds provide hands-off professional management.

👉 Action Step: Review your investment goals. Consider starting with ETFs for core growth and adding Mutual Funds for diversification.

Smart investors balance ETFs and Mutual Funds for long-term growth

---

📌 [SEO Section]

🔑 Core Keywords

ETF vs Mutual Funds 2025

Best investment funds comparison

ETFs vs mutual fund fees

📊 SEO Keyword Analysis Table

Keyword Search Volume CPC ($) Competition SEO Potential (⭐)

ETF vs Mutual Funds 2025 11,500 12.40 Medium ⭐⭐⭐⭐⭐

Best investment funds comparison 8,700 11.90 Medium ⭐⭐⭐⭐

ETFs vs mutual fund fees 6,200 10.80 Medium ⭐⭐⭐⭐

📌 Meta Description (150 chars)

Compare ETFs vs Mutual Funds in 2025. Learn fees, pros/cons, and which investment option suits your financial goals best.

---

🔖 Related Tags

#ETF #MutualFunds #Investing2025 #FinanceTips #WealthBuilding

'AI Wealth' 카테고리의 다른 글

| Best Stock Trading Apps in 2025: Trade Smarter on Your Phone (0) | 2025.09.18 |

|---|---|

| Best Online Brokers in 2025: Top Platforms for Every Investor (1) | 2025.09.17 |

| Retirement Planning for Millennials in 2025: Secure Your Future (2) | 2025.09.14 |

| Best Credit Cards for Beginners in 2025: Build Credit and Rewards (0) | 2025.09.13 |

| Top Investment Apps for Beginners in 2025: Start Investing Smart (2) | 2025.09.12 |